A general view shows commercial buildings in Yiwu, east China's Zhejiang province. AFP.

August’s data shows China’s recovery from the pandemic continues to slow, putting this year’s official GDP target of ‘around 5%’ growth at risk now.

Source: Bank of Singapore, Bloomberg

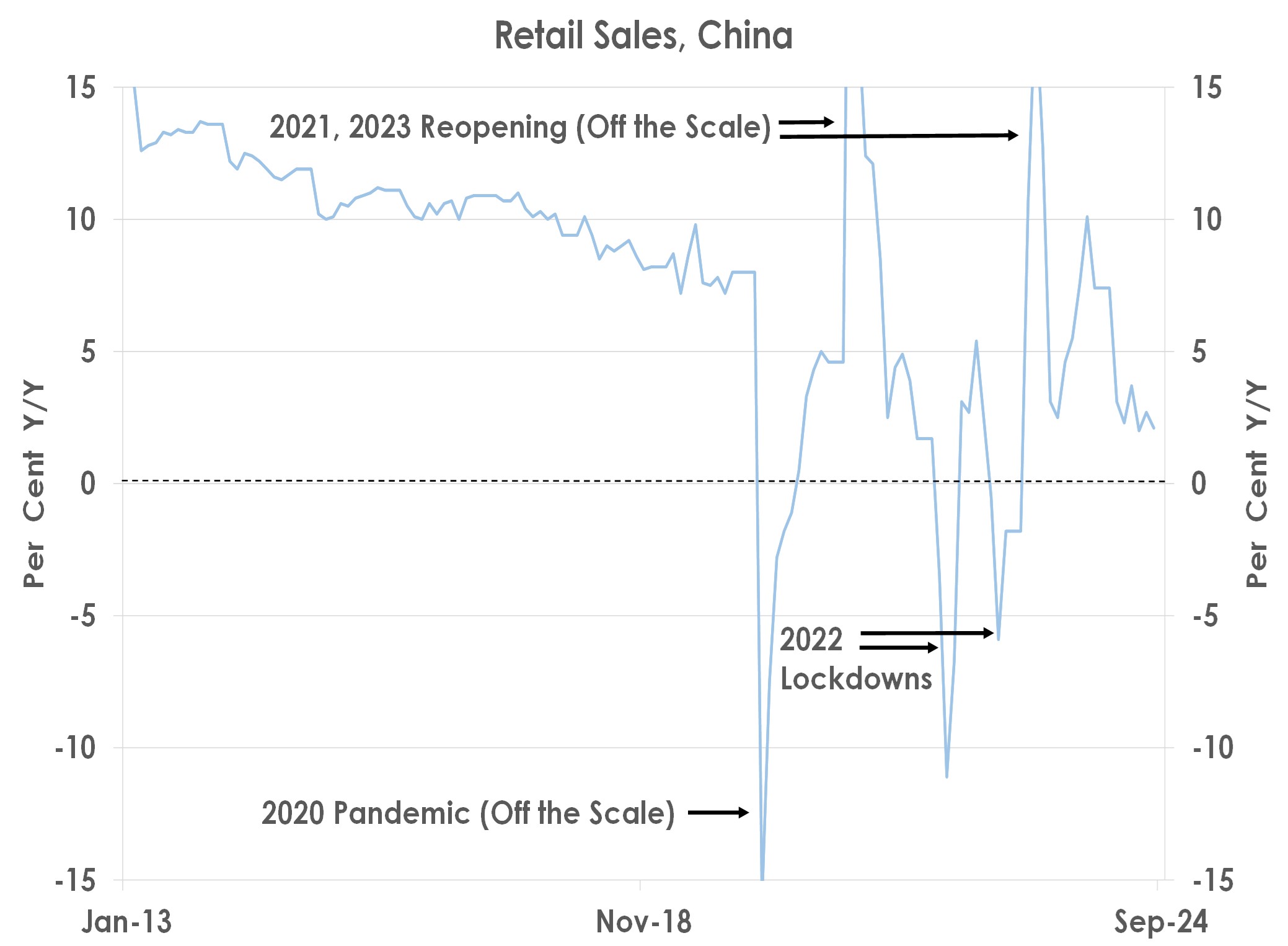

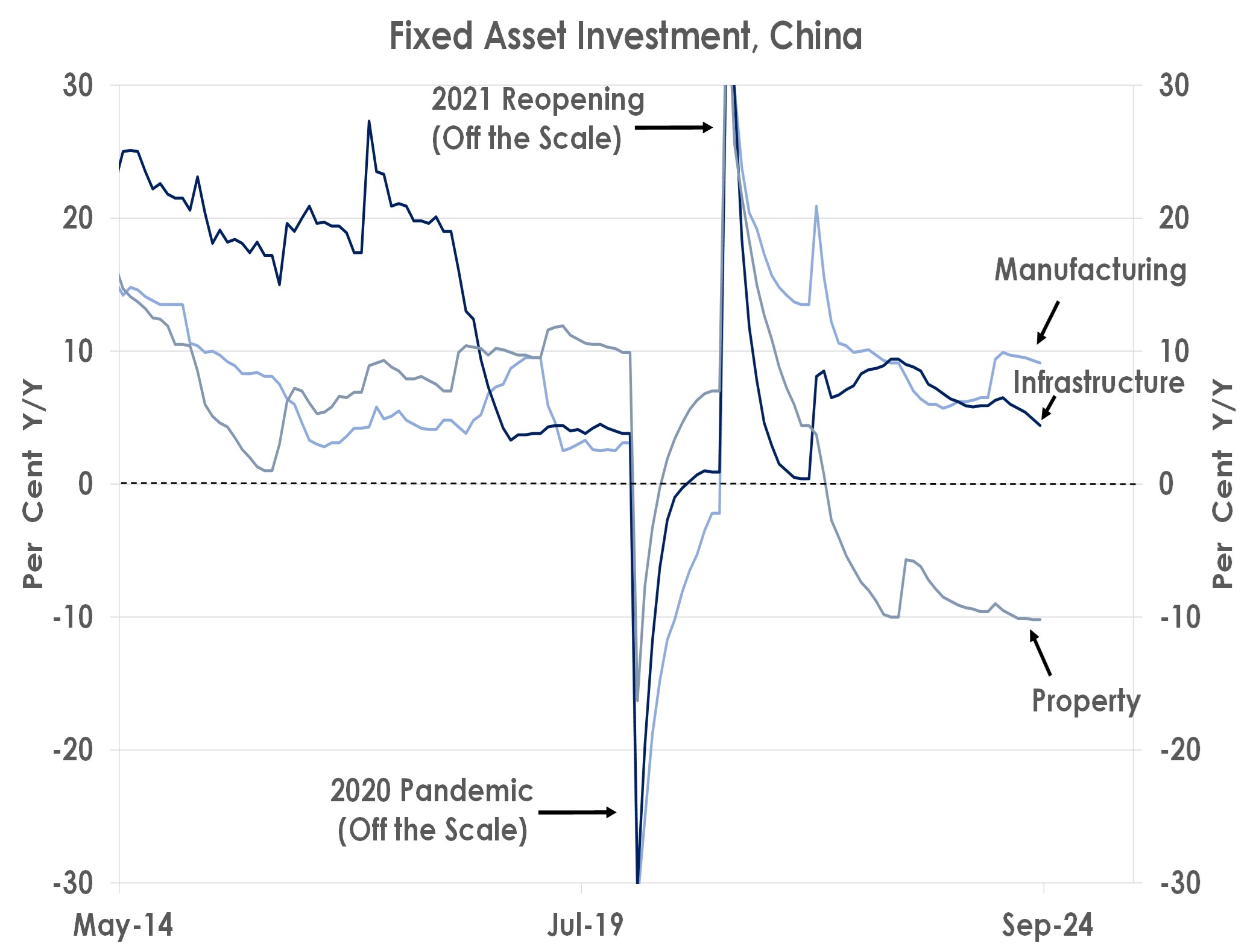

China’s challenge comes from subdued demand. Consumers remain cautious after the pandemic. Retail sales only rose 2.1% YoY last month - in contrast, retail sales were expanding by 8.0%YoY before the virus struck in 2020 as the chart above shows - and property investment contracted by 10.2% YoY, as the second chart shows, as China’s real estate markets stayed fragile.

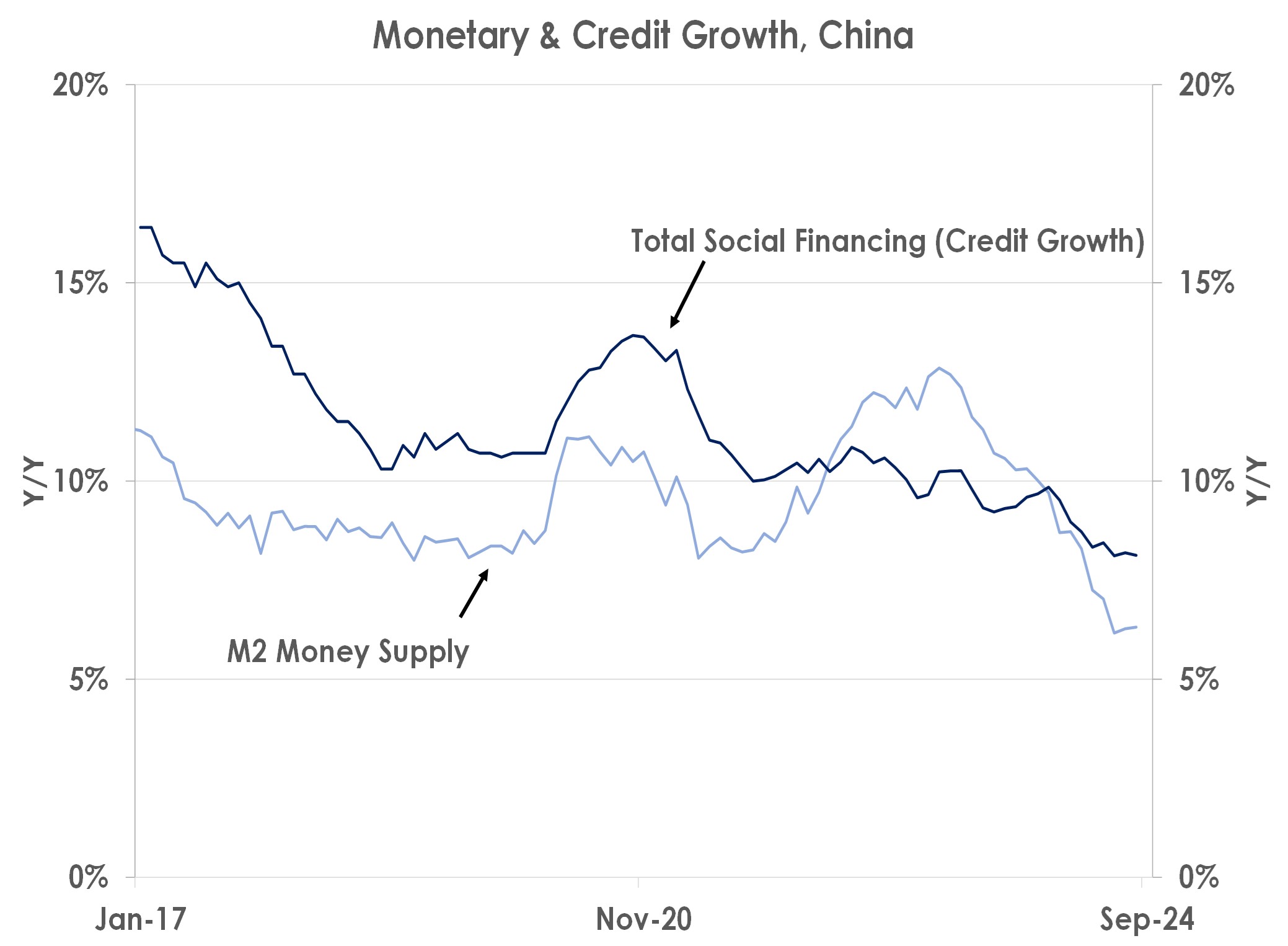

The lack of confidence has resulted in low demand for new loans. Credit growth was weak at just 8.1% YoY last month as the third chart shows.

Source: Bank of Singapore, Bloomberg

China’s supply side is firmer than demand but here too August’s data showed industrial production growth fell from 5.1% YoY to 4.5% YoY despite manufacturing investment expanding 9.1% YoY and exports growing 8.7% YoY.

Source: Bank of Singapore, Bloomberg

Thus, after a strong start to 2024 when Q1 GDP rose 5.3% YoY, 2Q24 growth eased to 4.7% YoY and is on track to fall to only 4.0% YoY in 3Q24.

In 4Q24, we think growth may rebound to 5.0% YoY. Government bond issuance to fund new investment is stepping up as August’s credit data showed and the People’s Bank of China is set to cut interest rates again. However, GDP growth is set to miss this year’s official target now.

Important information

This product may only be offered: (i) in Hong Kong, to qualified Private Banking Customers and Professional Investors (as defined under the Securities and Futures Ordinance); and (ii) in Singapore, to Accredited Investors (as defined under the Securities and Futures Act) and (iii) in the Dubai International Financial Center to Professional Clients (as defined under the Dubai Financial Services Authority rules) only. No other person should act on the contents of this document.This product may involve derivatives. Do NOT invest in it unless you fully understand and are willing to assume the risks associated with it. If you have any doubt, you should seek independent professional financial, tax and/or legal advice as you deem necessary.

Please carefully read and make sure that you understand all Risk Disclosures, Selling Restrictions, and Disclaimers. This document must be read together with the relevant Prospectus & Offering Documents &/or Key Fact Statement.

Disclaimer

The Bank, its Affiliates and their respective employees are not in the business of providing, and do not provide, tax, accounting or legal advice to any clients. The material contained herein is prepared for informational purposes and is not intended or written to be used, and cannot be used or relied upon for tax, accounting or legal advice. Any such client is responsible for consulting his/her own independent advisor as to the tax, accounting and legal consequences associated with his/her investments/transactions based on the client’s particular circumstances.

This document and other related documents have not been reviewed by, registered or lodged as a prospectus, information memorandum or profile statement with the Monetary Authority of Singapore nor any regulator in Hong Kong or elsewhere.

This document may not be published, circulated, reproduced or distributed in whole or in part to any other person without the Bank’s prior written consent. This document is not intended for distribution to, publication or use by any person in any jurisdiction outside Singapore, Hong Kong, or such other jurisdiction as the Bank may determine in its absolute discretion, where such distribution, publication or use would be contrary to applicable law or would subject the Bank and its related corporations, connected persons, associated persons and/or affiliates (collectively, “Affiliates”) to any registration, licensing or other requirements within such jurisdiction.