US Federal Reserve Chair, Jerome Powell. AFP.

The USD has declined recently and is now close to the lows of mid-2023. EURUSD reached a new 2024 high earlier last month, raising the question of whether the FX market is on the verge of a sustained USD downturn. It is understandable to associate the Federal Reserve (Fed) rate cut cycle with a weaker USD and lower yields, but historical reality is not as straightforward.

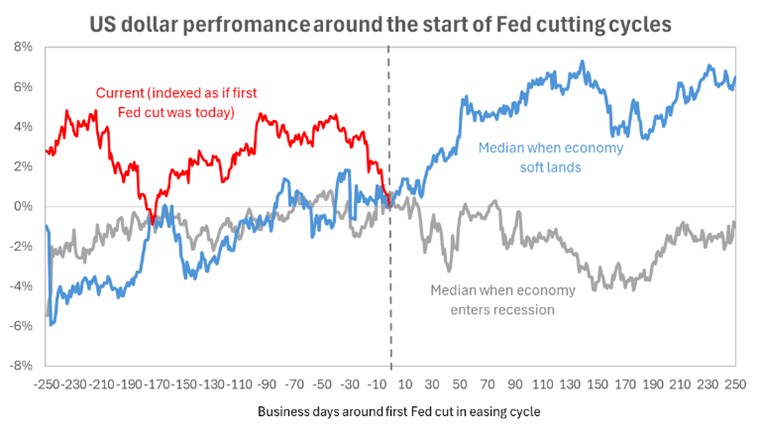

During the past six cutting cycles since 1983, the median return of the USD was roughly flat 12 months after the first Fed cut. However, the path of the USD is dependent on the trajectory of economic growth. The USD typically rises by 6% 12 months after the first Fed cut if the US economy achieves a soft landing (3 episodes: 1984, 1995, 2001), but falls by 1% if the economy has a hard landing (3 episodes: 1989, 2007, 2019) (Exhibit 1). This insight on what constitutes a soft landing is adapted from Alan Blinder, “Landings, Soft and Hard: The Federal Reserve, 1965-2022,” Journal of Economic Perspectives, Winter 2023.

Exhibit 1: Fed cuts, USD drops? Historical reality is not as straightforward

Source: Bloomberg, BIS, Bank of Singapore.

In the current cycle, the USD is approaching the expected September Fed rate cut with historically high valuations, largely as a consequence of the USD’s yield advantage over the past two years and superior US asset market returns. Rising Fed easing expectations triggered by the recession scare in early August has fuelled an unwinding of carry trades that benefitted funding currencies like the JPY and CHF. Asian exporters, who had been "hoarding" USD, have also stepped up USD conversion into Asian currencies. US equity markets have been quick to recover from the recession scare. But USD and US bond yields remain slow to do so, as the Fed’s emphasis on avoiding a further weakening of the labour market created asymmetric risk.

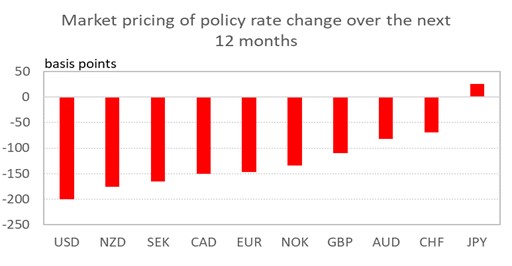

Exhibit 2: Markets could now be at risk of expecting too much Fed rate cuts and too little elsewhere

Source: Bloomberg, Bank of Singapore.

The USD is down but not out in our view. Ingredients for a sustained USD fall remain missing if we are right that the US labour market data supports a soft landing. The Fed is likely to take a more gradual easing path than what is now priced. Markets could now be at risk of expecting too much Fed rate cuts and too little elsewhere (Exhibit 2).

It is helpful to remember that FX is a relative game. The non-US side of the FX story matters just as much. It is tough to see the EUR and CNY materially challenging the USD given the Euro area’s stagnation risk and China’s deflation risk. US election risks continues to pose uncertainty to the broad USD and CNY view in 2025. There is also a tariff threat depending on the US election outcome. We anticipate USD gains to be linked to an increasing likelihood of a Trump 2.0 or a Red Sweep scenario.

Important information

This product may only be offered: (i) in Hong Kong, to qualified Private Banking Customers and Professional Investors (as defined under the Securities and Futures Ordinance); and (ii) in Singapore, to Accredited Investors (as defined under the Securities and Futures Act) and (iii) in the Dubai International Financial Center to Professional Clients (as defined under the Dubai Financial Services Authority rules) only. No other person should act on the contents of this document.This product may involve derivatives. Do NOT invest in it unless you fully understand and are willing to assume the risks associated with it. If you have any doubt, you should seek independent professional financial, tax and/or legal advice as you deem necessary.

Please carefully read and make sure that you understand all Risk Disclosures, Selling Restrictions, and Disclaimers. This document must be read together with the relevant Prospectus & Offering Documents &/or Key Fact Statement.

Disclaimer

The Bank, its Affiliates and their respective employees are not in the business of providing, and do not provide, tax, accounting or legal advice to any clients. The material contained herein is prepared for informational purposes and is not intended or written to be used, and cannot be used or relied upon for tax, accounting or legal advice. Any such client is responsible for consulting his/her own independent advisor as to the tax, accounting and legal consequences associated with his/her investments/transactions based on the client’s particular circumstances.

This document and other related documents have not been reviewed by, registered or lodged as a prospectus, information memorandum or profile statement with the Monetary Authority of Singapore nor any regulator in Hong Kong or elsewhere.

This document may not be published, circulated, reproduced or distributed in whole or in part to any other person without the Bank’s prior written consent. This document is not intended for distribution to, publication or use by any person in any jurisdiction outside Singapore, Hong Kong, or such other jurisdiction as the Bank may determine in its absolute discretion, where such distribution, publication or use would be contrary to applicable law or would subject the Bank and its related corporations, connected persons, associated persons and/or affiliates (collectively, “Affiliates”) to any registration, licensing or other requirements within such jurisdiction.