US Secretary of Treasury, Scott Bessent. AFP.

The US Treasury department announced its quarterly refinancing plans for the Feb to Apr 2025 quarter. The Treasury further indicated that it anticipates maintaining nominal coupon auction sizes for “at least the next several quarters”.

Bond market reacted positively as this suggest issuance may stay steady for the rest of the year. 10Y UST yields declined 11bps to 4.42% while the 30Y UST yield fell by 13bps to 4.64%.

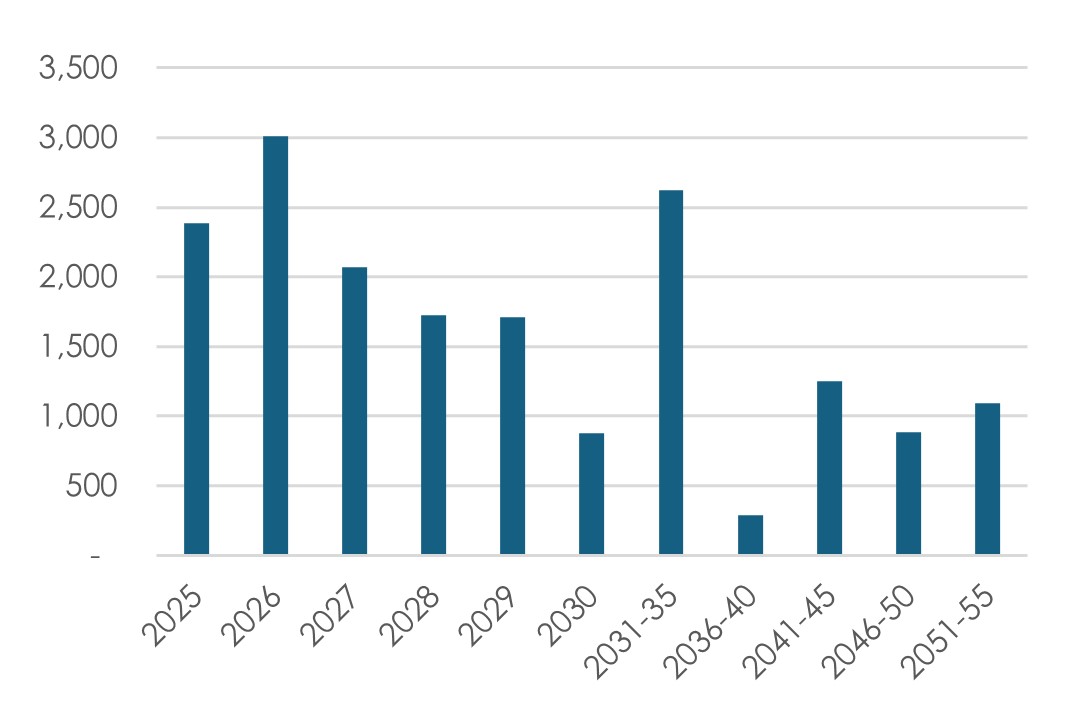

In 2025, the US Treasury’s financing needs are estimated to be USD4.5t. This includes USD2.5t of maturing UST and an estimated USD2t in fiscal deficit (Source: Congressional Budget Office). This will primarily be financed through an annual issuance size of ~USD4.4t. However, the US government’s funding needs is expected to pick up to USD5t in 2026, with ~USD2t fiscal deficit and USD3t of UST due for refinancing (Exhibit 1).

The USD2t fiscal deficit assumptions exclude the impact of the 2017 Tax Cuts and Jobs Act (TCJA) extension. The extension of the tax cuts would add USD4.6t to fiscal deficits over the next 10 years, assuming no further adjustments (Source: www.cfrb.org).

Exhibit 1: US government’s maturity profile (USD ‘b)

Source: US Treasury

While the US Treasury has boosted T-bill auction sizes to plug the funding gap, there is now limited capacity to further rely on T-bills. Presently, T-bills forms 21.9% of outstanding US Treasury debt, which is above the Treasury Borrowing Advisory Committee’s recommended range of 15-20%.

These suggest that US Treasury is expected to face a large funding gap in 2026 if it follows the same cadence of coupon issuance (of ~ USD4.4t a year). Therefore, we anticipate the Treasury to guide for an increase in issuances in early 2026.

Higher deficits and an increase in issuance requirements suggest investors demanding a higher term premium, driving long-end yields higher. We maintain an Underweight recommendation on UST and expect 10Y UST yields to reach 5% over the next 12 months.

Important information

This product may only be offered: (i) in Hong Kong, to qualified Private Banking Customers and Professional Investors (as defined under the Securities and Futures Ordinance); and (ii) in Singapore, to Accredited Investors (as defined under the Securities and Futures Act) and (iii) in the Dubai International Financial Center to Professional Clients (as defined under the Dubai Financial Services Authority rules) only. No other person should act on the contents of this document.This product may involve derivatives. Do NOT invest in it unless you fully understand and are willing to assume the risks associated with it. If you have any doubt, you should seek independent professional financial, tax and/or legal advice as you deem necessary.

Please carefully read and make sure that you understand all Risk Disclosures, Selling Restrictions, and Disclaimers. This document must be read together with the relevant Prospectus & Offering Documents &/or Key Fact Statement.

Disclaimer

The Bank, its Affiliates and their respective employees are not in the business of providing, and do not provide, tax, accounting or legal advice to any clients. The material contained herein is prepared for informational purposes and is not intended or written to be used, and cannot be used or relied upon for tax, accounting or legal advice. Any such client is responsible for consulting his/her own independent advisor as to the tax, accounting and legal consequences associated with his/her investments/transactions based on the client’s particular circumstances.

This document and other related documents have not been reviewed by, registered or lodged as a prospectus, information memorandum or profile statement with the Monetary Authority of Singapore nor any regulator in Hong Kong or elsewhere.

This document may not be published, circulated, reproduced or distributed in whole or in part to any other person without the Bank’s prior written consent. This document is not intended for distribution to, publication or use by any person in any jurisdiction outside Singapore, Hong Kong, or such other jurisdiction as the Bank may determine in its absolute discretion, where such distribution, publication or use would be contrary to applicable law or would subject the Bank and its related corporations, connected persons, associated persons and/or affiliates (collectively, “Affiliates”) to any registration, licensing or other requirements within such jurisdiction.